Finance Minister Unveils Bold Budget with Maximum Relief for Lower and Salaried Class

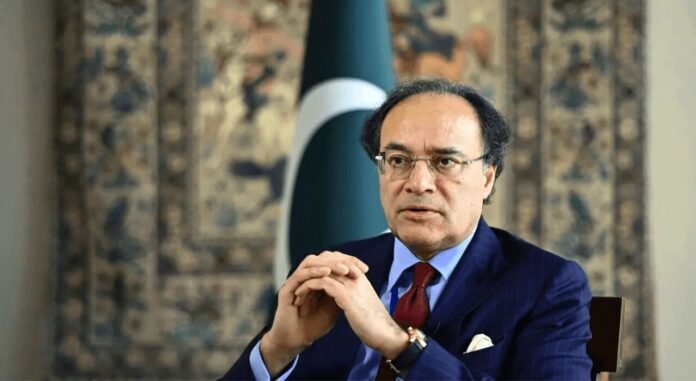

Federal Finance Minister Senator Muhammad Aurangzeb has stated that the government has provided the maximum possible relief to lower-income and salaried groups in the proposed federal budget for the fiscal year 2025–26. In an exclusive interview following the presentation of the budget, the finance minister emphasized that the government remains committed to protecting the country’s working class during a time of economic recovery and reform.

Speaking candidly about the current financial environment, Senator Aurangzeb said that the budget reflects a careful balancing act between fiscal discipline and social responsibility. “We have made every effort to offer meaningful relief to the salaried and lower-income population while ensuring economic stability,” he noted. “This is a people-centric budget.”

Personal Accountability and Transparency

In a notable statement, the finance minister took full personal responsibility for the financial figures shared in the budget document. This rare gesture was intended to increase public trust and highlight the seriousness with which the current administration is approaching fiscal policy. “I stand by the numbers presented in the budget. Transparency and accountability are our top priorities,” he said.

The minister also outlined efforts to reduce unnecessary government expenditures and increase efficiency across public departments. This includes a crackdown on wasteful spending, better monitoring of public sector projects, and greater scrutiny of procurement processes. Finance Minister

Simplified Tax Filing for Salaried Individuals

One of the most significant reforms announced was the upcoming introduction of a simplified tax return form, specifically designed for salaried individuals. According to Senator Aurangzeb, the new form will contain just 8 to 9 essential columns and is aimed at easing the burden of compliance for millions of workers who are already contributing to the tax system through payroll deductions.

“This change is part of our broader tax reform agenda. We want to create a tax culture that is fair, easy to follow, and inclusive,” he explained. The move is expected to boost voluntary compliance and improve the country’s overall tax-to-GDP ratio, which has historically remained below potential.

Commitment to Flexibility and Public Feedback

Acknowledging that budgets often face implementation challenges, the finance minister stated that the government is open to adjustments if any part of the budget proves ineffective or counterproductive. “No budget is perfect, and we are ready to revise measures if needed. We welcome constructive feedback from all stakeholders,” he said.

This willingness to adapt and respond to public concerns reflects a shift toward a more responsive and participatory style of governance, which the current administration has pledged to uphold.

Green Energy Push: Introduction of Carbon Levy

Another important component of the 2025–26 budget is the introduction of a new carbon levy. The levy is designed to encourage the transition from fossil fuels to cleaner and more sustainable energy sources, such as solar and wind power. The revenue generated from this levy will be reinvested into green infrastructure and environmental initiatives.

“We cannot ignore climate change. The carbon levy is part of our vision for a greener, more sustainable Pakistan,” said Senator Aurangzeb. The initiative aligns with global climate commitments and positions Pakistan as a responsible player in environmental matters.

National Finance Commission Meeting Scheduled

The finance minister also confirmed that the next meeting of the National Finance Commission (NFC) is expected to be held by August 2025. The NFC Award determines how resources are distributed between the federal government and the provinces. “The NFC discussions are crucial for strengthening fiscal federalism, and we are fully committed to engaging all stakeholders in a constructive dialogue,” he said.

See more:

Conclusion

The 2025–26 federal budget, as outlined by Senator Muhammad Aurangzeb, is being presented as a forward-looking and reform-driven framework aimed at offering targeted relief to the most vulnerable segments of society. With a focus on transparency, tax simplification, and environmental responsibility, the government hopes to not only stabilize the economy but also build a fairer and more sustainable financial future for all Pakistanis.