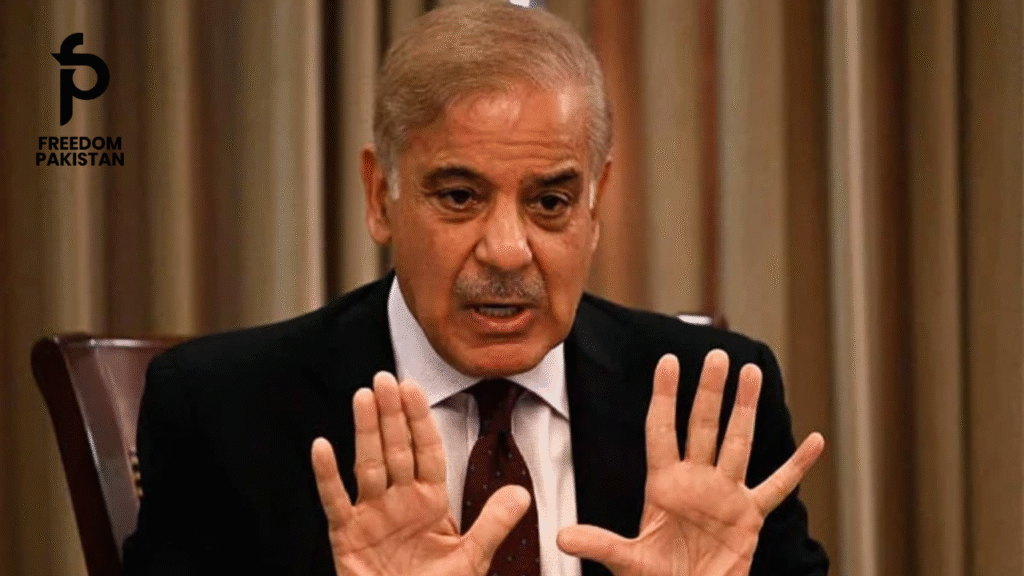

Prime Minister Shehbaz Sharif has introduced a landmark reform in Pakistan’s tax enforcement system by setting six strict conditions for arrest in tax fraud cases. The move is part of the government’s broader effort to promote fairness, transparency, and accountability within the Federal Board of Revenue (FBR) and to reduce unnecessary harassment of taxpayers. These newly established criteria aim to ensure that only those truly guilty of serious tax fraud face arrest, while honest taxpayers are protected from arbitrary action.

A Shift Toward Tax Justice

Historically, Pakistan’s tax enforcement regime has been criticized for allowing arrests without proper investigation, often leading to harassment, reputational damage, and a general sense of fear among the business community. With tax compliance already low, PM Shehbaz Sharif’s intervention intends to build public trust and encourage voluntary participation in the tax system by ensuring that enforcement follows a structured and fair legal framework.

The Six Conditions for Arrest in Tax Fraud Cases

Prime Minister Shehbaz Sharif has outlined six mandatory preconditions that must be met before any arrest is made in tax fraud cases:

-

Clear Evidence of Intentional Fraud

Arrests will only be allowed where there is documented, verified evidence showing a deliberate intent to commit tax fraud—not in cases of clerical errors or misinterpretations. -

Completion of Investigation or Audit

A taxpayer cannot be arrested during an ongoing audit or investigation. Arrests are permissible only after an inquiry is completed and guilt is established. -

Approval from Higher Authorities

Any arrest in a tax fraud case must receive clearance from senior FBR officials or a designated review board to ensure checks and balances in the process. -

Right to Respond Before Arrest

Taxpayers must be given an opportunity to respond to the allegations, rectify any errors, or provide additional documentation before enforcement action is taken. -

Legal Vetting Process

Before an arrest warrant is executed, the case must undergo a legal review to confirm that it meets the necessary threshold under tax laws. -

Large-Scale or Habitual Offenders Only

Arrests will be focused on serious offenders involved in large-scale tax evasion or repeat violations—not minor infractions or first-time errors.

Stakeholder Reactions

The business community has welcomed the announcement, calling it a “breath of fresh air” for legitimate enterprises that often live in fear of tax raids. Many tax professionals view this reform as a step toward due process and predict it will increase compliance rates. Meanwhile, FBR officials have expressed support for the conditions, saying they will streamline enforcement while protecting the department from legal backlash or corruption allegations.

Implications for Pakistan’s Tax System

By setting clear boundaries on arrests in tax fraud cases, the government is sending a strong message: tax enforcement must be responsible, justified, and fair. These conditions are likely to:

-

Boost taxpayer confidence in the system.

-

Encourage individuals and businesses to voluntarily declare their income.

-

Improve Pakistan’s image in international financial and business circles.

-

Make the country more attractive to local and foreign investors.

Implementation Challenges

While the policy is a positive development, its success depends on consistent implementation across the country. Training FBR officers to follow these new guidelines and developing a transparent oversight mechanism will be crucial. There is also concern that vague definitions—such as what constitutes “intentional fraud“—could be misused if not clearly defined in supporting legislation.

Conclusion

PM Shehbaz Sharif’s decision to set six legal safeguards before arrests in tax fraud cases marks a progressive shift in Pakistan’s tax enforcement strategy. If implemented effectively, it could balance the need for accountability with the rights of taxpayers, fostering a healthier tax culture nationwide. This reform positions Pakistan toward a more modern, transparent, and fair tax administration—one that encourages compliance rather than fear.